On average, over 90 percent of what God has allowed believers to manage, is NOT cash.

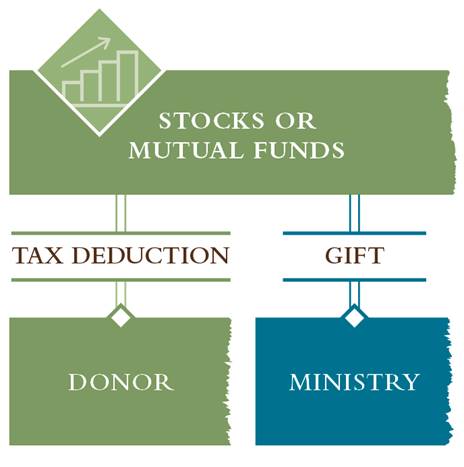

Often God has blessed us with unique assets to steward for His glory. And because the government incentivizes charitable giving, there are often tax benefits available for donations of these assets to Focus on the Family. If you own appreciated stocks or mutual funds, this may be the best way to give charitably.

Benefits of stocks, bonds & mutual funds

- Avoid capital gains tax on the sale of long-term appreciated stocks, in most cases

- Receive a charitable income tax deduction, in most cases

- Help further the work and mission of Focus on the Family immediately

How to make a gift

Transfer Instructions for Making a Gift of Securities to Focus on the Family

Gifts of appreciated securities are a smart and simple way to maximize the effectiveness of your charitable giving. If stocks or mutual funds* you’ve held for more than a year have increased in value, you may want to consider using these assets – rather than cash – to fund your giving. By transferring ownership of your long-term stock to Focus on the Family you make a gift to support the ministry, avoid the capital gains tax you would pay if the stock were sold, and you may claim a charitable income tax deduction for the current fair market value of the asset.

*Does not apply to tax-exempt retirement plans (e.g., IRAs, 401(k)s, etc.)

Mutual Fund Transfers: These transfers can be complicated. Please call Focus on the Family’s Gift & Estate Planning department at 1-800-782-8227 to find out how to transfer mutual funds.

Stock Transfers:

DTC Transfer – If you have your shares of stock in a brokerage account, this is a convenient way to transfer your securities. Simply instruct your broker to electronically transfer your securities out of your account into Focus on the Family’s Charles Schwab or Merrill Lynch account and provide the appropriate account information below:

| Charles Schwab FBO: Focus on the Family DTC #: 0164 Code 40 Account #: 8391-9885 | Merrill Lynch FBO: Focus on the Family DTC #: 8862 Account #: 210-04035 |

By Direct Registration Shares (DRS): Contact the transfer agent for your specific security to obtain the form required to transfer shares to Focus on the Family.